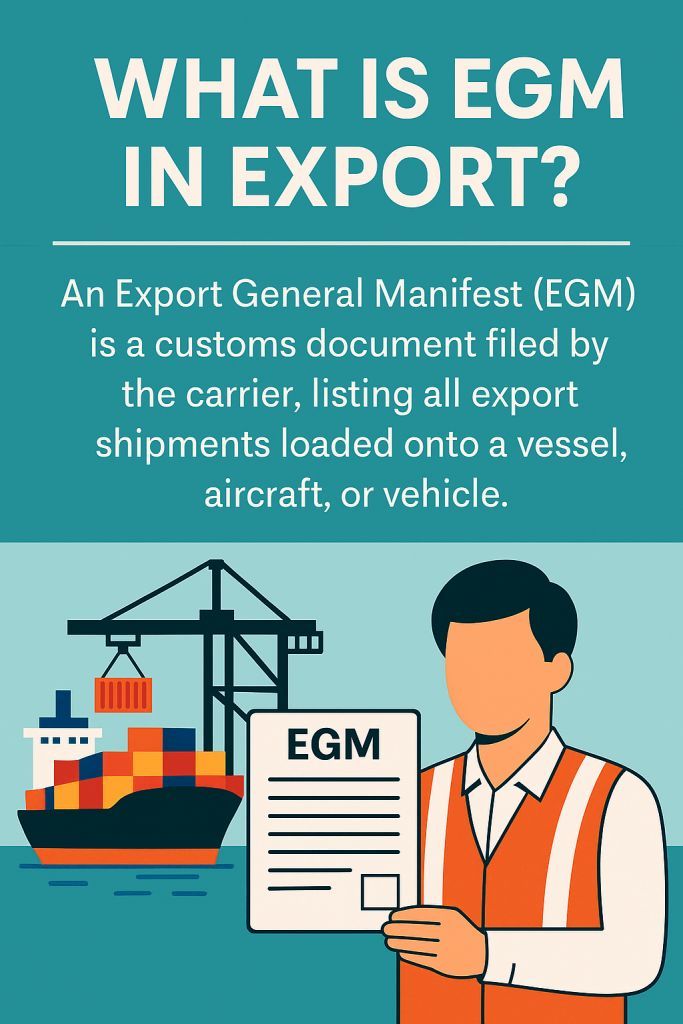

What Is EGM in Export and Why It Matters for Indian Exporters

New to international trade? Before you dive into the nuts and bolts of the Export General Manifest, skim our How to Start an Export Business in India in 2025 – Beginner’s Guide. It walks you through business set‑up, IEC registration, and market research—perfect context for this EGM primer.

The Export General Manifest (EGM) is a vital customs document in international trade. In India, it’s the carrier’s formal declaration of all export shipments loaded onto a vessel, aircraft or vehicle. Filing the EGM is a legal requirement under the Customs Act, 1962 – it serves as proof that the goods have left the country. In practice, the shipping line or airline (known as the person-in-charge of the conveyance) must submit the EGM to Indian Customs before the carrier departs. The EGM essentially ties together your shipping bills and the physical export; without it, customs and tax authorities will not consider your export complete.

Think of the EGM as the final “green light” for an export. It ensures all cargo on board is accounted for. By reviewing the EGM, customs confirms that goods listed on shipping bills have actually sailed. This is critical for export benefits and tax refunds – for example, an exporter cannot claim duty drawback or an IGST refund unless a valid EGM is filed. In fact, as Amazon’s India exports guide notes, “According to Rule 96 of the CGST Rules, 2017, an exporter cannot apply for a refund of IGST on exported goods if an EGM is not obtained”. In short, timely and correct EGM filing is indispensable for new exporters and freight forwarders.

Who Files the EGM in Export? (Carriers, Not Exporters)

In the process of EGM in Export, it is the carrier, not the exporter, who is responsible for filing the Export General Manifest. This includes shipping lines for sea freight, airlines for air cargo, and transport operators for land exports. According to Indian Customs regulations, the person in charge of the conveyance—or their authorized agent—must submit the EGM detailing all export shipments on board.

While exporters themselves don’t file the EGM in export procedures, they must closely coordinate with carriers to ensure that all their shipping bill details are accurately included in the manifest. This step is essential to avoid refund delays and shipping bill errors on ICEGATE.

If you’re still mapping out your first shipment timeline, bookmark How to Start an Export Business in India in 2025 – Beginner’s Guide for step‑by‑step planning alongside the EGM checklist.

What Does the EGM in Export Contain and Why It’s Required

The EGM form (for ships or planes) follows the Export Manifest Regulations, 1976. It includes the carrier’s details (vessel name, voyage number, captain, etc.) and, crucially, the cargo details: all shipping bill numbers, exporter names, consignees, package descriptions, quantities, weights, values and destination ports. It even notes any transhipments or unshipped items.

Customs uses the EGM to verify exports against shipping bills, check that no cargo was illicitly added or omitted, and to mark exports as complete. In practice, once the goods physically depart, the filed EGM in Export is the document that officially records the export. On its basis, Customs will release the Export Promotion copy of the shipping bill to the exporter. That EP copy – together with any duty drawback entries or Area Licence (ARE) forms – is what exporters need to claim export incentives. In short, the EGM ties together shipping bills with export realization; it provides the government’s stamp that the shipment truly left India.

Manual vs. Electronic EGM Filing

Traditionally, EGM in Export forms were submitted manually on paper, but today India uses the ICEGATE (Indian Customs EDI) portal for electronic filing. In fact, most major ports mandate electronic EGM in Export submission via ICEGATE before departure. Even so, a manual copy of the EGM in Export (with the exporter’s copies of the shipping bills) is still submitted at the port’s export office as a record. In practice, the carrier or CHA logs into ICEGATE and sends the Export Manifest message, while an identical paper EGM form is simultaneously filed onsite. Customs registers the manual EGM and returns an acknowledgement slip. Over time, electronic EGM has become the norm – only in rare cases (e.g. remote customs stations with no connectivity) would a fully manual EGM be needed.

Key point: Even if your export is small, the carrier must file the EGM in the prescribed format. If relying on ICEGATE e-filing, make sure the carrier gets it done. If they do it electronically, their agent still must sign and hand over the manual EGM and shipping bills at the port, completing the customs process.

Fig: Large container ship docked at a port. Carriers must file an EGM covering all cargo loaded for export on such vessels.

Types of EGMs (Shipping Bill-Wise vs. Consolidated) and Mode Differences

Shipping Bill-wise vs. Consolidated EGM: In Indian practice, one EGM typically covers all shipments on a single carrier voyage. However, terminology can vary. A shipping bill-wise EGM means the manifest lists each shipping bill individually, whereas a consolidated EGM would combine multiple shipping bills (from possibly different exporters) into one entry. In effect, if a container carries cargo from several exporters (each with its own shipping bill), the carrier will prepare one consolidated manifest listing all those bills. In ICEGATE, carriers can file manifest entries per shipping bill or in bulk – the result is the same: one EGM with multiple SBs. Whether consolidated or not, the carrier’s job is to ensure every shipping bill on board is covered by the EGM.

By mode of transport:

- Sea shipments: EGM in Export (sometimes called a Master Export Manifest) is filed by the shipping line. It includes all export containers/vans on the vessel. If goods are sent by an inland container depot (ICD) to a port, the same rule applies. If the carrier fails to e-file EGM in Export at the gateway port, the IGST refund system flags SB006: Gateway EGM not available.

- Air exports: Airlines file an Air Export Manifest, the air equivalent of EGM in Export. It lists all air waybills (HAWBs/Master AWBs) on the flight. The customs instructions are analogous – the cargo carrier must submit the manifest to customs on departure. (Some training materials still call it an EGM for simplicity.)

- Land exports (road/rail): These use an Export Report or Land EGM, often simplified due to the nature of overland transport. For example, exports by truck or train might require a simplified list of shipping bills. But the principle remains: customs must have a manifest of all export goods crossing the border.

In all modes, the outcome is the same: Customs gets a list of exports. A missing land manifest can block excise refund claims, just as a missing sea EGM blocks GST refunds.

Fig: Cargo aircraft ready for export flight. Air carriers also file an export manifest (EGM) to certify goods have flown out of India.

How to File an EGM in Export in India (Step-by-Step)

- Complete the Export Formalities and Get LEO. First, the exporter (through a CHA) files the shipping bill on ICEGATE and obtains the Let Export Order (LEO) from Customs. The LEO is the export clearance stamp on the shipping bill copy that lets goods move out. Without LEO, you cannot load cargo for export. Once LEO is given and customs has examined the cargo, the physical export occurs.

- Gather Shipping Details for the Carrier. The exporter or CHA should inform the carrier (shipping line/airline) about the shipment details – shipping bill numbers, container/flight details, weights, etc. Provide clean, matching data (exporter name, IEC, port codes, invoice numbers) so the EGM in Export can be prepared without error.

- Carrier Prepares the Manifest. Near departure, the carrier’s manifest clerk compiles all shipping bills and cargo details for that voyage. Using ICEGATE’s Export General Manifest webform (or their own customs messaging software), they create the EGM in Export entry. They must enter each SB number, exporter/consignee, item descriptions, package counts, weight, and value. (The ICEGATE EGM form has fields for port of loading, discharge, and any transshipment.)

- File Electronically on ICEGATE. The carrier (or their agent) logs into ICEGATE and submits the EGM data. Upon successful filing, the ICEGATE system assigns an EGM number and records the manifest against each shipping bill. Ideally this happens before the ship sails; Customs expects advance filing.

- Submit Manual EGM at Port. Simultaneously, a paper copy of the EGM (and all shipping bills’ export copies) is submitted to the customs export office at the port. Customs staff will stamp the arrival time/date and keep it as a register. The carrier’s agent gets back an acknowledgement stamp – a crucial record that the EGM in Export was officially presented.

- Confirm Filing and Address Errors. After filing, the carrier or exporter should check that the EGM status is reflected in the system. ICEGATE now tracks EGM in Export filings. In the ship’s export report, the status will show “EGM Filed” or may display an error code if something is wrong. Any errors (SB002/SB006, etc.) should be resolved immediately (see next section).

- Obtain EP Copy and BRC. Once the EGM in Export is filed, Customs will mark the shipping bill with an approved status. The exporter can then get the Export Promotion (EP) copy of the SB – this is the official proof of export. After receiving payment, the exporter’s bank issues a Bank Realization Certificate (BRC or eBRC). Together, the EP copy and BRC allow the exporter to claim GST/IGST refunds, duty drawbacks or other incentives.

Each of these steps must be completed carefully. Delays or mistakes in filing the EGM can leave exports “in limbo” (see below). Exporters should ideally watch these steps as closely as if they were filing the shipping bill themselves – after all, export benefits hinge on the EGM’s accuracy.

For a master list of every paper or e‑form you’ll encounter—from Shipping Bill to eBRC—read Essential Export Documents Required in 2025 – Complete Guide for Exporters. Pairing that guide with this EGM tutorial ensures no document gaps derail your refund claims.

EGM’s Link to Shipping Bill, LEO, BRC and Export Incentives

The EGM in Export is intrinsically linked to the shipping bill and post-export paperwork:

- Shipping Bill and LEO: The shipping bill is filed by the exporter at the outset. After goods are examined and duties (if any) paid or secured, Customs grants the Let Export Order (LEO) on the shipping bill – this is the official clearance to export. The LEO is essentially Customs’ initial approval. However, this alone isn’t proof that goods actually left. That proof comes after export, via the EGM in Export.

- EGM in Export and EP Copy: Once the EGM is filed post-departure, Customs considers the export complete. It then releases the Export Promotion copy (EP copy) of the shipping bill to the exporter. The EP copy is stamped “Let Export Order given” and lists the cargo exported. This EP copy is a key document for claiming export benefits – duty drawbacks, Rebate of State and Central Taxes (RoSCTL/ erstwhile MEIS), and any export promotion schemes. In essence, the EP copy (backed by the EGM) is the evidence of actual export.

- Bank Realization Certificate (BRC): Many export incentives (especially under GST/IGST rules) require confirmation that the foreign currency has been realized. To this end, once payment from the importer arrives, the authorized bank issues a BRC (now typically an electronic BRC uploaded to ICEGATE/DGFT). The combination of the EP copy of the SB (from Customs) and the BRC (from the bank) completes the picture: Customs sees what was exported and that payment was received. Only then can drawbacks or tax refunds be finalized.

- Export Incentives and Refunds: For example, under the IGST refund rules, an exporter’s shipping bill is deemed an “application” for refund as soon as it’s filed. But the refund only actually processes once both the EGM in Export and a valid GST return (GSTR-3B) are filed. Similarly, duty drawback claims can only be sanctioned after Customs verifies the EGM against the SB. If EGM in Export is not filed, the EP copy won’t be issued, and the exporter cannot claim those benefits.

In short, the EGM in Export is the critical “missing link” that ties your export documentation and foreign payment together. Without it, the export process is not formally closed.

Remember, the EGM sits squarely among the documents outlined in our Essential Export Documents Required in 2025 – Complete Guide for Exporters; cross‑check both lists so every export file is audit‑ready.

Consequences of Incorrect or Delayed EGM Filing

Failing to file the EGM in Export correctly – or on time – can have serious repercussions:

- Customs Departure Delays: If the port authority detects that the EGM in Export hasn’t been filed (or has errors) before sailing, the carrier may not be allowed to sail. A missing or incorrect EGM can delay vessel or flight departures due to compliance checks. This can incur demurrage or detention charges, which an exporter or shipper may ultimately have to bear.

- Export Order Revocation: In theory, if goods are shipped without an EGM in Export, customs could consider them as “not exported” from India. This might force the exporter to repeat certain procedures or even pay taxes.

- Tax Refund / Duty Drawback Blocks: The most common issue for exporters is blocked refunds. ICEGATE’s IGST refund portal will flag error code SB002 (“EGM not filed”) or SB006 (“Gateway EGM not available”) if the EGM in Export is missing. Similarly, other checks like SB003 (GSTIN mismatch) can appear if data doesn’t align. The upshot is that the IGST refund will be held up until the EGM in Export issue is resolved.

- Penalties for False Declaration: EGM is a legally binding document. If the carrier (or its agent) knowingly enters incorrect details, they face penalties under the Customs Act. While this often falls on the carrier side, exporters can be affected (e.g. if forged invoices are found in the EGM).

- Blocked Export Incentives: Until the EP copy is released, any export incentive claims (drawback, RoDTEP, etc.) remain pending. As one guide warns, “Incorrect or missing EGMs can cause departure delays and penalties”, and may also result in lost or delayed export benefits.

In practice, the SB002/SB006 error codes are the exporter’s cue that the EGM needs attention. These codes trigger ICEGATE and GSTN to halt processing. The remedy is usually straightforward: contact the carrier to file or correct the EGM immediately. In severe cases of negligence, Customs can impose fines or confiscate goods, but usually exporters see financial impact via delays and denial of refunds.

Example of Error Messages: ICEGATE can display errors like “SB002: EGM not filed” or “SB006: Gateway EGM not available”. These specifically mean the EGM was never uploaded or is stuck. Exporters seeing SB002 on their shipping bill status must “approach their shipping line/carrier to file the EGM” immediately. If a mismatch in GSTIN is flagged (SB003), the exporter must amend the GST return (via Form GSTR-9A) to match the shipping bill. The key is: don’t ignore these codes – they are telling you why refunds/incentives are blocked.

Late EGMs can trigger vessel detention or yard storage fees. Our post on Demurrage, Detention, and Free Time in Shipping: Complete Guide for Exporters and Importers details how these charges pile up—and how timely manifests help you avoid them.

How Exporters Can Track and Verify EGM Filing

Coordinate with your Carrier: Before departure, give your carrier or freight forwarder the final shipping bill list and any updates (changes in cargo, containers, etc.). Ask them for the vessel/voyage number or flight details they will use in the EGM. Some exporters request the booking number or manifest number from the carrier as proof that EGM will be filed.

Use ICEGATE to Check Status: Exporters can monitor the status on ICEGATE’s portal. The “Know Your Shipping Bill Status” service (under Services) shows key updates. After logging in (or even without an account via “General User”), go to Shipping Bill → Status Query. Enter your shipping bill number, date and port. The status lines will include steps like “SB Approved”, “LEO Given” and “EGM Filed”. If “EGM Filed” appears, the manifest is in the system. If not, or if you see an error code, follow up. (Note: LEO must already be given for “EGM Filed” to show.)

Resolve Errors Promptly: If ICEGATE shows SB002/SB006 or if refunds aren’t processed after a few days, immediately contact the carrier’s local office or your CHA. Remind them of any pending EGM. Often, if the carrier filed manually but forgot to transmit electronically, they can still log into ICEGATE and file the webform on the fly. Sometimes filing a supplementary declaration or amendment via ICEGATE can clear the error. Remember that IBG (bank detail) issues or GSTN mismatches can also cause SB errors, so keep your GST records and bank accounts linked properly.

ICEGATE Job Status for EGMs: Per Customs instructions, you can also check filed EGMs directly under Job Status. In ICEGATE, select “Job Status” → choose SEA EGM or AIR EGM and your port. It will list all manifest messages filed recently from that location. This is more technical, but it’s how Customs checks the message logs.

Follow Up until Closure: After “EGM Filed” appears, make sure the EP copy of the SB is released to you (usually on ICEGATE under SB query). Once you receive the shipment’s payment, file your export realization return with the EP copy and eBRC so everything closes. If you plan to claim drawback or any scheme, verify with the customs office or use ICES (Indian Customs EDI System) reports that the SB is cleared.

Common EGM in Export Errors and How to Fix Them

Customs and ICEGATE have a set of error codes for missing or mismatched data. Exporters should know the most common ones relating to EGM:

| Error Code | Meaning | Action Required |

|---|---|---|

| SB002 | “EGM not filed”. The export manifest is missing. | Approach the shipping line/airline immediately and request them to file the EGM for your shipment. |

| SB006 | “Gateway EGM not available” (often on ICD shipments). | Same remedy as SB002 – ensure the carrier files the EGM electronically. If already filed, have them re-submit or refresh it. |

| SB003 | “GSTIN mismatch”. The GSTIN on your shipping bill and GST returns don’t match. | Amend the GST return (GSTR-1) using Form 9A to correct the GSTIN in Customs records. |

| SB005 | “Invalid invoice number”. Invoice info doesn’t match the SB details. | Correct the invoice number in the export documentation or through amendment. |

| SB004 | “Record already received” (rarely for EGM issues). | Usually no action; might mean duplicate filing. |

Knowing these codes helps you troubleshoot. For example, if you see SB002 in your ICEGATE SB status, remember the Mumbai Customs FAQ: “Exporter has to approach their shipping line/airline/carrier to file the EGM”. In every case, the export can’t be finalized until these are cleared.

Best Practices to Avoid EGM in Export Mistakes

- Accurate Documentation: Ensure all shipping bill details (exporter name, GSTIN, port codes, invoice numbers) are correct and match your exports. These get used in the EGM. Mismatches (like a wrong port code) trigger errors. Double-check your shipping bill entries before export.

- Early Coordination: Inform the carrier of changes or delays. If your goods are delayed or the ship’s departure is late, ask for an EGM extension if needed. The “Timing of Filing” rules allow a 7-day window after departure, but ideally file before sailing.

- Use Trusted Partners: Work with reliable shipping lines or freight forwarders (ASCs) who know ICEGATE processes. Experienced partners can file EGMs promptly.

- Monitor ICEGATE Daily: After loading, check ICEGATE’s SB status every day until “EGM Filed” appears. Set up SMS/e-mail alerts via ICEGATE if possible. Don’t wait weeks to find out.

- Keep Records: File the manual EGM in Export acknowledgement and the electronic manifest receipt in your export files. That way, if Customs asks, you have proof that the EGM was filed.

- Understand Charges: If an EGM error forces re-export or local clearances, it can trigger extra fees (port storage, reassessment, etc.). Plan buffer time and funds to avoid last-minute hassles.

- Stay Informed: Rules can change. For instance, while duty drawback once required a physically stamped Shipping Bill, newer regulations rely on ICEGATE data. Keep up with CBIC circulars. Amazon’s guide and ICEGATE FAQs (linked below) are useful.

- Train Your Team: If you’re a new exporter, make sure your logistics/CHA knows about EGM. Conduct quick briefings: “Remember, EGM in Export must be filed before the vessel’s final departure or we risk SB002.”

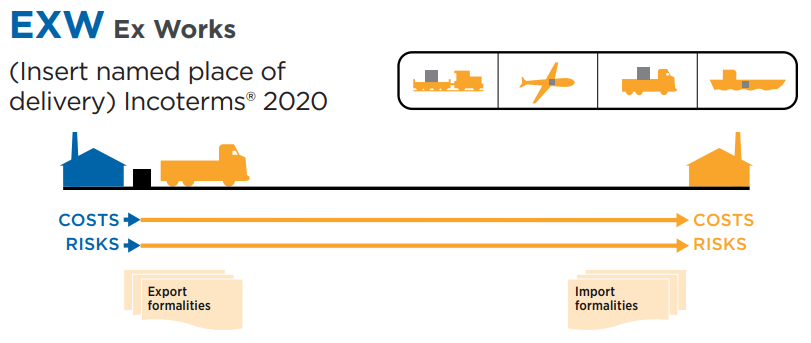

Align your EGM timelines with the obligations set in Incoterms Explained: The Ultimate Guide for Global Trade so freight forwarders and buyers share clear responsibilities.

Below is a quick stepwise checklist for exporters:

- File SB and get LEO: Complete all customs clearance on the shipping bill. Ensure it’s error-free.

- Communicate details: Send final shipping bill numbers, invoice numbers, & container info to the carrier.

- Check SB status: On ICEGATE, watch for “LEO Given”. Only after LEO can goods move.

- Confirm EGM with carrier: After loading, ask the carrier to e-file EGM (check for SB002/SB006).

- Verify EGM Filed: Use ICEGATE status or the “Job Status” portal to see if the manifest is in.

- Request EP copy: Once EGM is filed, obtain the Export Promotion copy from Customs.

- Submit BRC and claims: Provide the EP copy to your bank for eBRC, and file refunds/drawback on time.

By following these best practices, exporters can avoid common pitfalls. A little vigilance – coordinating with carriers and monitoring ICEGATE – goes a long way in keeping exports smooth.

Summary

The Export General Manifest (EGM in Export) is the linchpin that confirms goods have left India. For Indian exporters, understanding EGM in Export is essential. It’s filed by the carrier (not the exporter), contains all shipping bill details, and must be submitted in ICEGATE before the vessel/flight leaves. Once filed, it triggers the release of the Export Promotion copy of the shipping bill and unlocks export incentives like drawback or IGST refund. Conversely, missing or incorrect EGMs cause errors (SB002/SB006) that block refunds and can delay departures.

In practice, exporters should: ensure the carrier files the EGM in Export on time, verify status on ICEGATE, and correct any SB errors immediately. Coordinating closely with your shipping line or airline – and tracking ICEGATE shipping bill status – will help avoid headaches. By treating the EGM in Export as a critical final step (not an afterthought), exporters keep customs happy and cash flows steady. With proper care, the EGM in Export becomes just one more routine step in a smooth export process, enabling you to claim your benefits without hassle.

Use the prevention tips in Demurrage, Detention, and Free Time in Shipping: Complete Guide for Exporters and Importers to keep costs down while you perfect your EGM in export workflow.

FAQ 1: What is an Export General Manifest (EGM in Export) in shipping?

Answer:

An Export General Manifest (EGM in Export) is a customs document submitted by the carrier (such as a shipping line, airline, or transport operator) to Indian Customs. It lists all goods loaded onto a ship, aircraft, or vehicle for export. Filing the EGM confirms that the cargo has physically left the country and is a mandatory step to complete the export process in India.

FAQ 2: Who is responsible for filing the EGM in Export in India?

Answer:

In India, the EGM is filed by the carrier or its authorized agent—not the exporter. For sea shipments, it’s usually the shipping line; for air exports, the airline files it. However, exporters must coordinate with the carrier to ensure their shipping bills are included in the manifest.

FAQ 3: Why is EGM filing important for exporters?

Answer:

Without a filed EGM, Customs does not consider the goods as “exported.” This means exporters cannot get the Export Promotion (EP) copy of their shipping bill, claim GST refunds, duty drawback, or other export incentives. Errors like SB002 and SB006 on ICEGATE often indicate EGM-related issues.

FAQ 4: How can an exporter check if EGM has been filed?

Answer:

Exporters can check EGM status through the ICEGATE portal under the “Shipping Bill Status” service. After entering their shipping bill details, they should look for the status update “EGM Filed.” If not found, they must follow up with the shipping line or airline.

FAQ 5: What happens if EGM is not filed or has errors?

Answer:

If the EGM is not filed or contains errors, exporters may face:

- Blocked IGST refunds (error codes SB002 or SB006)

- Delays in customs clearance

- Rejection of export incentives

- Potential penalties or reassessments

Promptly correcting these issues with the carrier and coordinating with customs is essential to avoid financial and procedural delays.

Click to watch a simplified explanation : EGM in custom | EGM in Export | what is egm in export | EGM Custom in Hindi

Very nice, Thanks.