Exporting goods to international markets is a promising way to grow your business. However, one of the most critical stages in the export process is customs clearance. Without it, your shipment can get delayed, penalized, or even rejected.

In this guide, you’ll learn everything about the customs clearance process for start an export business in India, from documentation to inspection, and how to avoid costly mistakes.

What is Customs Clearance in Export?

Customs clearance refers to the official process of getting permission from the customs authority to move goods out of the country. It involves submitting the required documents, paying applicable duties (if any), and complying with government regulations.

Once cleared, the goods are allowed to be shipped internationally from the port or airport.

Why Customs Clearance is Important

- Legal Compliance

Ensures your goods are legally approved for export. - Avoid Delays

Missing documents or errors can cause shipping delays and additional demurrage costs. - Accurate Data Collection

Helps the government track export statistics and enforce trade policies. - Prevent Penalties

Helps exporters avoid fines and blacklisting from customs authorities.

Key Stakeholders in the Export Customs Process

| Stakeholder | Role in Customs Process |

|---|---|

| Exporter | Submits documents and complies with regulations |

| Customs House Agent (CHA) | Facilitates the clearance process on behalf of exporter |

| Freight Forwarder | Arranges transportation & shipping |

| Customs Officer | Inspects and approves the export shipment |

| Port Authority | Manages movement of cargo through port |

Step-by-Step Customs Clearance Process for Export

Let’s break down the process into easy steps:

Step 1: Documentation Preparation

Prepare the necessary Export Documents Required such as:

- Commercial Invoice

- Packing List

- Shipping Bill

- Certificate of Origin

- Bill of Lading or Airway Bill

Step 2: Appoint a CHA or File Online

You can appoint a CHA (Customs House Agent) to handle the process or file customs clearance documents yourself via ICEGATE portal.

Step 3: Shipping Bill Generation

Submit documents online to generate a Shipping Bill (a must-have for all exports).

Step 4: Customs Examination / Inspection

Customs authorities may examine the goods physically to ensure they match declared specifications.

Step 5: Assessment & Let Export Order (LEO)

Customs reviews the documentation, evaluates the shipment, and issues a Let Export Order, which is the final approval for the cargo to leave the country.

Step 6: Export General Manifest (EGM) Filing

The carrier files the EGM after departure of the cargo — confirming that goods have physically left the port.

Read this Blog Also :

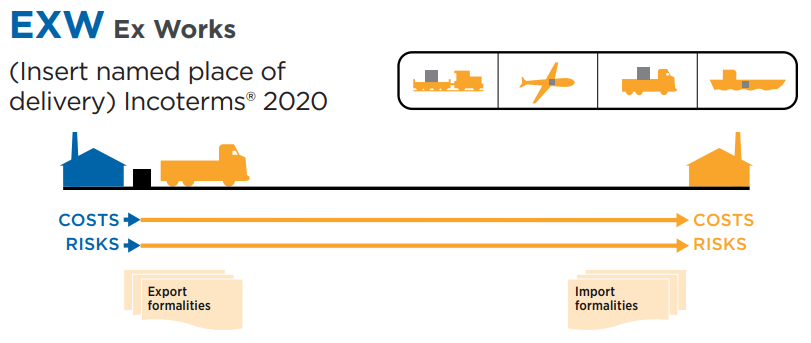

Incoterms Explained: The Ultimate Guide for Global Trade

List of Documents Required for Export Customs Clearance

Here are the most commonly required documents:

| Document | Purpose |

|---|---|

| Commercial Invoice | Details value, quantity, and goods description |

| Packing List | Information on packaging for easy inspection |

| Shipping Bill | Core document for customs clearance |

| Certificate of Origin | Verifies the origin of goods |

| Bill of Lading / Airway Bill | Proof of shipment from the carrier |

| Export License (if applicable) | For restricted items under DGFT regulations |

| Letter of Undertaking (LUT) | GST-related document for zero-rated supplies |

Role of Customs House Agent (CHA)

A CHA is licensed by Indian customs to handle customs-related formalities on behalf of exporters.

What a CHA does:

- Files Shipping Bills

- Coordinates with customs & port officials

- Handles inspections and container movement

- Ensures compliance with laws and duty payments

Although optional, having a good CHA can save you from major headaches, especially if you’re a new exporter.

Common Challenges in Export Customs Clearance

Here are some frequent issues exporters face:

- 📉 Incorrect HS Codes

- 📂 Incomplete or mismatched documentation

- ❌ Non-compliance with trade regulations

- 🧾 Manual filing errors

- 🕒 Delays in customs inspection

- 🚫 Restrictions on certain commodities without a license

Tips to Ensure Smooth Customs Clearance

- Double-check all documents before submission

- Stay updated with the latest customs policies via ICEGATE or DGFT

- Clearly label and pack goods as per international standards

- Work with an experienced CHA or freight forwarder

- Ensure HS Code and product descriptions are accurate

- Keep buffer time in your shipping plan for inspections

FAQs on Customs Clearance in Export

Q1: Can I do export customs clearance myself?

Yes, you can. But it is advisable to hire a CHA unless you are experienced with customs processes and portals like ICEGATE.

Q2: What is the cost of customs clearance for export?

It depends on the CHA charges, documentation, inspection needs, and container type. Typically, it can range between ₹3,000 to ₹10,000+.

Q3: How long does export customs clearance take in India?

If documents are correct, it may take 1–3 working days. Delays may happen due to inspection or technical issues.

Q4: What is a Shipping Bill in export?

It is the main legal document submitted to customs for clearance. Without it, no cargo can be exported.

Conclusion:

Navigating the custom clearance process is crucial for the success of your export business. From documentation to dealing with customs officers, each step must be handled with precision and care. Investing time in understanding the process—or working with reliable professionals—can help you avoid costly delays and ensure successful international shipments.

Pingback: Top 25 High margin export products from India - Exclusive

Pingback: Demurrage & Detention & Free Time in Shipping Explained